Complete a Home Inventory

If you are one of the almost 50% of U.S. households that has never completed a home inventory there is no time like the present.

Why is a Home Inventory Important?

A Home Inventory Checklist is a list of your valuable objects in case there is a fire, destructive storm or if someone breaks in and steals your belongings. Doing a home inventory is very important because without one many people have a difficult time pinpointing or recalling everything that might have been destroyed or taken, and unfortunately that can delay claims or keep you from getting full compensation. So, before the hectic holiday season rolls around, and take the time to take inventory of your home.

Just go room by room and document:

- Electronics

- Personal care items

- Jewelry

- Art

- Kitchen items and appliances

- Furniture

- Carpeting

- Beds and linens

- Clothing

- Sports equipment

- Yard and garden tools

You can choose to write everything down or use photo/video documentation of your belongings. Don’t forget to take pictures of the exterior of your home as well (photos are best from all angels- including the landscaping and any decks or porches). Also take note of everything in the garage, attic, or basement- like holiday ornaments, lawn and yard equipment, tools, etc.

Trying to tally what needs to be replaced is not something you want to do in the event of a claim, so completing your inventory will give you some peace of mind if the worst should happen; and you can use the time to get rid of the old and make room for the new, before the craziness of the holidays.

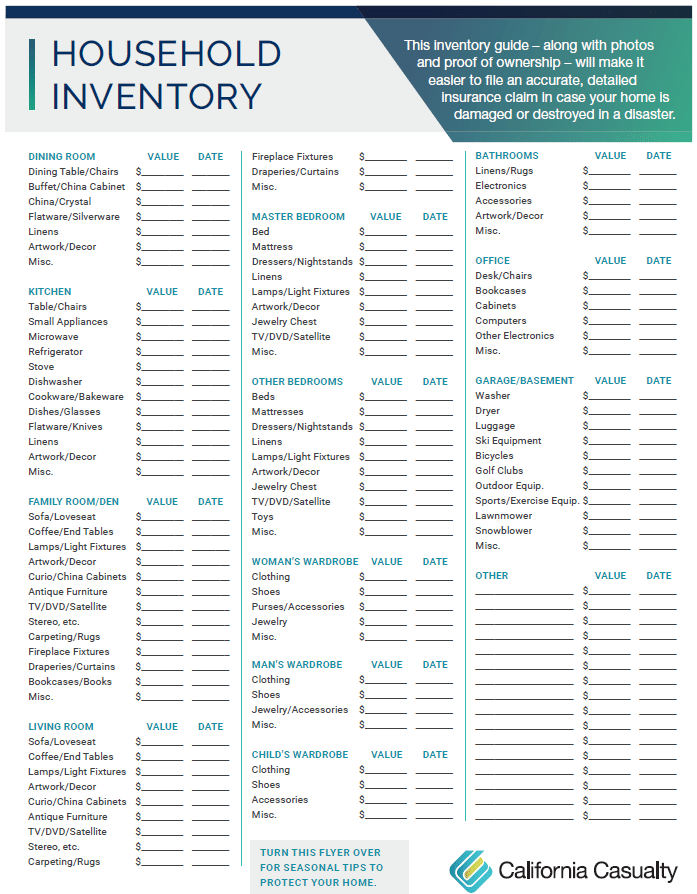

To help you out, we’ve got a handy home inventory guide already made just for you! You can download it by clicking on the “Household Inventory” image below.

New Year’s Resolution: Complete a Home Inventory

Here’s an unsettling statistic – about half of US households still haven’t completed a home inventory. Of those who have done one, 40 percent haven’t updated it in many years. It’s a resolution that we urge you to make.

Why? You’ve worked hard to make your house a home. Now it’s time to create a record of everything that you own. Trying to tally what needs to be replaced is not something you want to do in the event of a claim.

Home inventory is so important. It provides a list of your things in case there is a fire, destructive storm or someone breaks in and steals your valuable belongings. Without an inventory, many people have a difficult time pinpointing or recalling everything that might have been destroyed or taken. That could delay your claim or keep you from getting full compensation.

Whether you choose to write everything down or use a video camera (like your phone), now is a great time to get started. Just go room by room and document:

- Electronics

- Personal care items

- Jewelry

- Art

- Kitchen items and appliances

- Furniture

- Carpeting

- Beds and linens

- Clothing

- Sports equipment

- Yard and garden tools

Don’t forget to take pictures of the exterior of your home from all sides (including the landscaping and any decks or porches), and all the stuff in the garage, attic or basement (holiday ornaments, lawn and yard equipment, tools).

Completing your inventory will give you some peace of mind if the worst should happen. We’ve got a handy home inventory guide that you can download here.

Too Late is Too Late: Why you Need a Home Inventory

By Carrie Mitchell, Owner & Founder

TWS Home Inventory

Knowing the despair that follows a major loss, Carrie Mitchell founded TWS Home Inventory in 2012 after helping victims of the devastation caused by Colorado’s Waldo Canyon fire in. It was in the aftermath that Carrie realized how much heartache and stress could be avoided with a professionally detailed home inventory. TWS Home Inventory is now available in California and the East Coast.

Carrie and TWS Home Inventory have been featured in Colorado media, FOX News National, FOX News Business, the Insurance Journal and the Huffington Post. Carrie will be providing us with important content about the need for a home inventory and the many ways not having one could hurt you.

California Casualty proudly insures a sector of society that knows all too well the importance of being proactive instead of reactive in our everyday lives. As educators, health care providers, fire fighters, first responders, and peace officers you see the devastating aftermath of situations outside of our control.

TWS Home Inventory and Asset Management Group was founded in 2012 as a direct result of the plight of affected homeowners in the aftermath of Colorado’s Waldo Canyon Fire. As a homeowner personally affected by this natural disaster that devastated the Colorado Springs area in 2012, I saw first-hand the trail of destruction left behind: over 350 homes destroyed and countless numbers severely damaged, 18,247 acres of forest blackened, firefighting costs alone were over $15 million, home losses and insurance claims were estimated at over $356 million two years after the fire, and many claims remain in dispute even after three years.

Although most homes were insured, the financial recovery for contents was much less than the insured structure amount and for valuables such as jewelry, guns, paintings, family heirlooms and antiques. Many of these precious possessions were simply lost forever. The simple reason for this fact is that most homeowners had no physical record or documentation of their valued possessions, let alone were even able to remember a fraction of the items lost. Now, three years later, many homeowners are still struggling to itemize their possessions leaving them with a feeling of being victimized a second time.

As a volunteer assisting these homeowners, the idea for a professionally documented home inventory service was born and TWS Home Inventory and Asset Management Group was formed. In 2013, the Black Forest Wildfire brought even greater devastation to the Colorado Springs area with over 511 homes destroyed and it was followed by the Waldo Canyon Flood.

The Root of the Problem

Once insured, a homeowner assumes that everything is covered and is totally unaware of the serious need for a documented inventory, much less the value that it adds to their insurance coverage. In my experience, most homeowners never read their policy to see what actually is and is not covered until they are in the claims process. Any loss, partial or total, requires some form of proof of ownership of contents, especially when it comes to specific valuable articles. Working with victims of loss, one thing seems to always be evident; homeowners tend to want to blame the insurance company for insufficient compensation. Unfortunately, few realize until after the fact that it is the homeowner’s responsibility prior to that loss to inform the insurance carrier of what they own to ensure proper coverage.

In the coming months we look forward to sharing with you the invaluable information learned over the past three years from homeowners affected by some of the worst natural disasters in recent years. Our goal in this series is to help educate proactive policyholders on the specific personal items you may own which need to have appraisals, floaters, riders, and endorsements not covered in a typical homeowner’s policy, because

When it’s too late….It’s too late!

You can learn more about Carrie Mitchell and free home inspection resources at

Home Warranty vs. Home Insurance

Understanding the difference between your home warranty and home insurance can save you from financial headaches when things go wrong at home. Let’s break down these two types of coverage to help you make informed decisions about protecting your property.

The Difference At-A-Glance

- Home warranties cover repairs and replacements for certain systems and appliances in your home.

- Home insurance covers property damage to your home, other structures, or belongings in the case of unexpected events like fires, hail, wind, vandalism, or theft.

Both come with limits on what they cover. Read on to find out more.

What You Need to Know About Home Warranties

The name, home warranty, can lead you to believe that this protection covers your home. That’s not exactly the case. Home warranties cover the major appliances and systems in your house.

- When you might purchase a home warranty

Home warranties are generally offered when you purchase a new appliance or system. Examples include washers, dryers, refrigerators, ovens, dishwashers, and garage door openers. You also may have a home warranty for electrical, plumbing, heating, and cooling systems. In case one of these “big ticket” purchases malfunctions, you can avoid a major out-of-pocket expense. The home warranty kicks in after the manufacturer’s warranty expires.

You can also buy a home warranty at any time directly from a home warranty company. Sometimes home warranties are offered as part of real estate transactions as an incentive to close the deal. Such warranties offer peace of mind for the future homeowner.

- What your home warranty covers

Home warranties usually cover service, repair, and replacement of a product for a covered problem and everyday wear and tear.

- What your home warranty doesn’t cover

Your policy might deny coverage if you have not been keeping up with maintenance. They also could deny coverage for improper installation or modifications, pest damage, or pre-existing conditions. Check your warranty policy for the details of what may be excluded from coverage.

- How coverage works

You file a claim. The warranty company connects you with an approved contractor to perform the repair. A technician visits your home to diagnose the appliance or the system, and to recommend a repair or replacement. There may be a service fee associated with this visit. If the repair is simple, the technician can do it the same day. If a replacement is needed or a part must be ordered, then a follow-up appointment is scheduled.

- When seeking a home warranty, be an informed consumer:

- Take an inventory of your large home appliances and systems. Write down their age and condition. Record the last time they were serviced.

- Estimate how much it will cost you to replace those systems. If you can afford to replace them without help, you do not need a home warranty.

- Consider a home inspection. This will document any pre-existing conditions that will not be covered by a warranty.

- Research coverages and payment amounts. Read the fine print. Many companies limit the amount that they will pay, and it may only be a portion of the appliance or system.

- Check that the company you choose is in good standing with the Better Business Bureau.

What You Need to Know About Home Insurance

A homeowner’s policy is a “package” of coverages. It protects your home and personal property from specific events that can damage them and provides additional living expenses if you are unable to live there due to an insured loss. In addition, your homeowner’s policy covers you for lawsuits or liability claims that might otherwise be your responsibility if you accidentally injure other people or damage their property.

- When you might purchase home insurance:

You will purchase home insurance when you buy your home. If you have a home mortgage, then maintaining homeowner’s insurance is generally a requirement of your loan agreement. Even if you own your home outright, it’s recommended that you protect your equity in the home by maintaining homeowner’s insurance.

- What your home insurance covers and doesn’t cover:

Following are highlights of what your home insurance policy covers and doesn’t cover. For details on these and other coverages, see our blog on Home Insurance 101.

-

- Dwelling coverage refers to the structure of your home: the roof, walls, floorboards, cabinets, and bath fixtures. A loss is covered unless it’s excluded by your policy.

- Other structures insurance covers pools, fences, gazebos, sheds, etc. A loss is covered unless it’s excluded by your policy.

- Personal property coverage protects your possessions, such as furniture, clothes, sports equipment, and other personal items. If your possessions are stolen, or damaged by fire/smoke or any of 16 covered “perils,” your policy will pay for them subject to your deductible.

- If your home is damaged in a covered loss, it may not be livable. If that’s the case, you would need to stay somewhere else. Loss of Use, also called Additional Living Expense, covers you for any necessary increase in living expenses, such as lodging, food, and gas.

- Personal Liability protects you if a claim is made or a suit brought against you for bodily injury or property damage caused by an occurrence to which coverage applies. Liability covers you at your place or anywhere in the world.

- If you are not liable, but your guest was injured through his/her own fault, then Coverage F – Medical Payment to Others may cover your guest’s medical bills.

- How coverage works:

You file a claim. You’ll fill out the necessary paperwork online or by email. For a homeowner’s or personal property claim, you will need to provide a Proof of Loss statement. That’s a list of items that were damaged or stolen and how much it costs to replace them. You may have to get a repair estimate and include that information. Then, you’ll wait for approval. Once the repair is authorized, you’ll be able proceed. Either you or the contractor will receive payment from the insurance company, so check with your adjuster. You will be responsible for the deductible amount, the amount that you will pay out-of-pocket before insurance kicks in.

- When seeking home insurance, be an informed consumer:

Estimate how much it would cost to rebuild your home from scratch in your current location. Also ballpark the cost to replace all your personal property. This will give you a starting point as to how much insurance you will need.

Determine if you will need specialized coverage beyond a standard homeowner’s policy. For example, you may want flood or earthquake coverage for your location.

-

-

- Shop around for insurance, and keep in mind, that it usually pays to buy home and auto coverage from the same company. When you bundle your home and auto insurance, you can often qualify for reduced rates, saving hundreds of dollars.

- Ask about discounts. You may qualify for insurance discounts for being part of a professional association, such as groups for teachers, nurses or first responders. There are also discounts for being retired, for paying via automatic bank payments, and for paying in full upfront.

- Check that the insurance company you choose is in good standing with the Better Business Bureau.

-

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.